Resources

Our downloadable resources provide practical guidance and tools to help make your compliance journey simpler.

Explore our tools and checklists.

Fiduciary Checklist for Group Health Plans

This checklist is for fiduciaries designed with HIPAA, ERISA, and CAA regulations in mind.

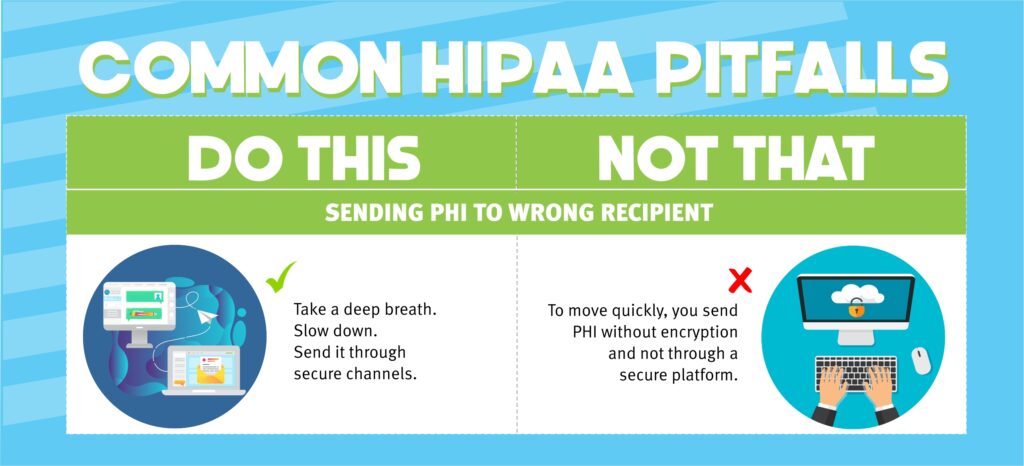

HIPAA Pitfalls: Do This, Not That!

5 quick tips for staying HIPAA compliant during busy seasons. Great to hang in a common area!

HIPAA Annual Checklist

So much can happen in a year - review your HIPAA materials annually!

What to Expect from a DOL Audit

Prepare before a DOLS with this step-by-step checklist.

What Happens When You Change Funding

When plan funding changes, so do compliance responsibilities.

The Richards Group Case Study

How one of our rockstar partners used The Dashboard in a DOL investigation.

ComplianceDashboard

Access upcoming and on-demand webinars

Discover our lineup of webinars and events, designed to empower and inspire you. Don’t miss out!

Expanded Preventative Services for Plan Year 2026: Breast Cancer Screening

On 12/30/24, the Health Resources and Services Administration (HRSA) issued a notice including an important revision focused on “Breast Cancer Screening for Women at Average

Mental Health Parity Final Rule (MHPAEA) Under Review by Agencies

Attention HR pros and benefit brokers! Portions of the Mental Health Parity Rule (MHPAEA) are under review by the agencies overseeing it. It’s shaping up

New Administration Takes HIPAA Security Rule Complaints Seriously

What HR Pros Need to Know About the Latest OCR Enforcement Update Here’s the key takeaway from the latest HIPAA Security Rule enforcement update: the

Boost Benefits Compliance (and Your HR Cred!)

We’re well on our way into the second quarter, and now’s the perfect moment to showcase your benefits compliance skills. With deadlines looming and tasks