More Organization,

Less Intimidation.

HIPAA10’s easy-to-follow 10-step process equips you with loads of guides, templates, and checklists to make compliance just a little less scary.

The HIPAA10 Difference

Developed for Plan Sponsors

HIPAA10 was created specifically for health plan sponsors with access to PHI, not medical providers, and focuses on the needs of HR and benefits departments.

Comprehensive Compliance

HIPAA compliance is more than generic notices and policy templates, and HIPAA10 has the tools and resources you need for plan compliance.

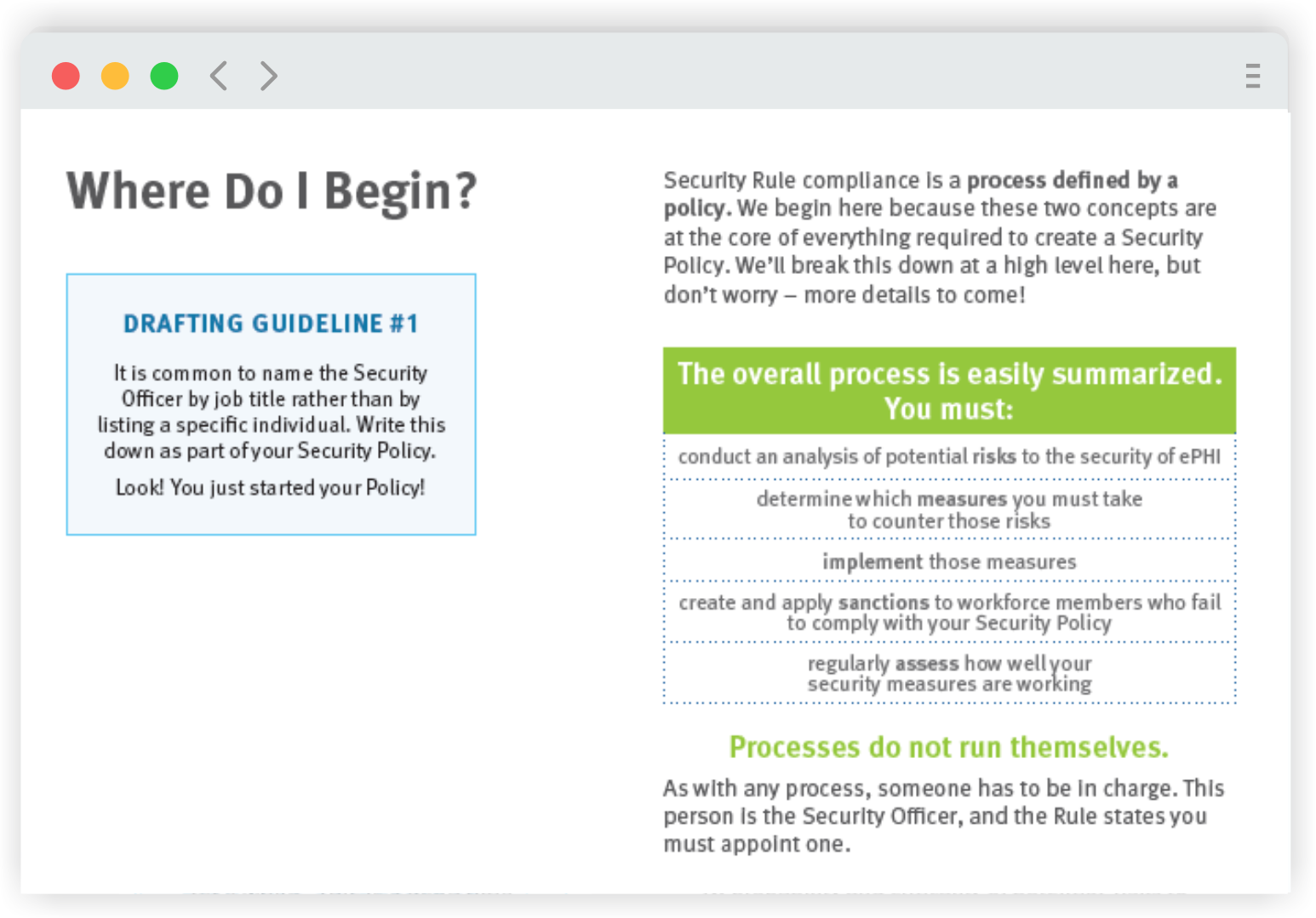

Step-by-Step Guidance

Choose your own adventure with HIPAA10’s self-paced steps. Start at the beginning and walk through all 10 steps or tackle your most urgent HIPAA need first.

Loads of Help Along the Way

Videos, guides, checklist, and practical tips from our leading ERISA attorneys help you customize your policies and procedures to your business practices.

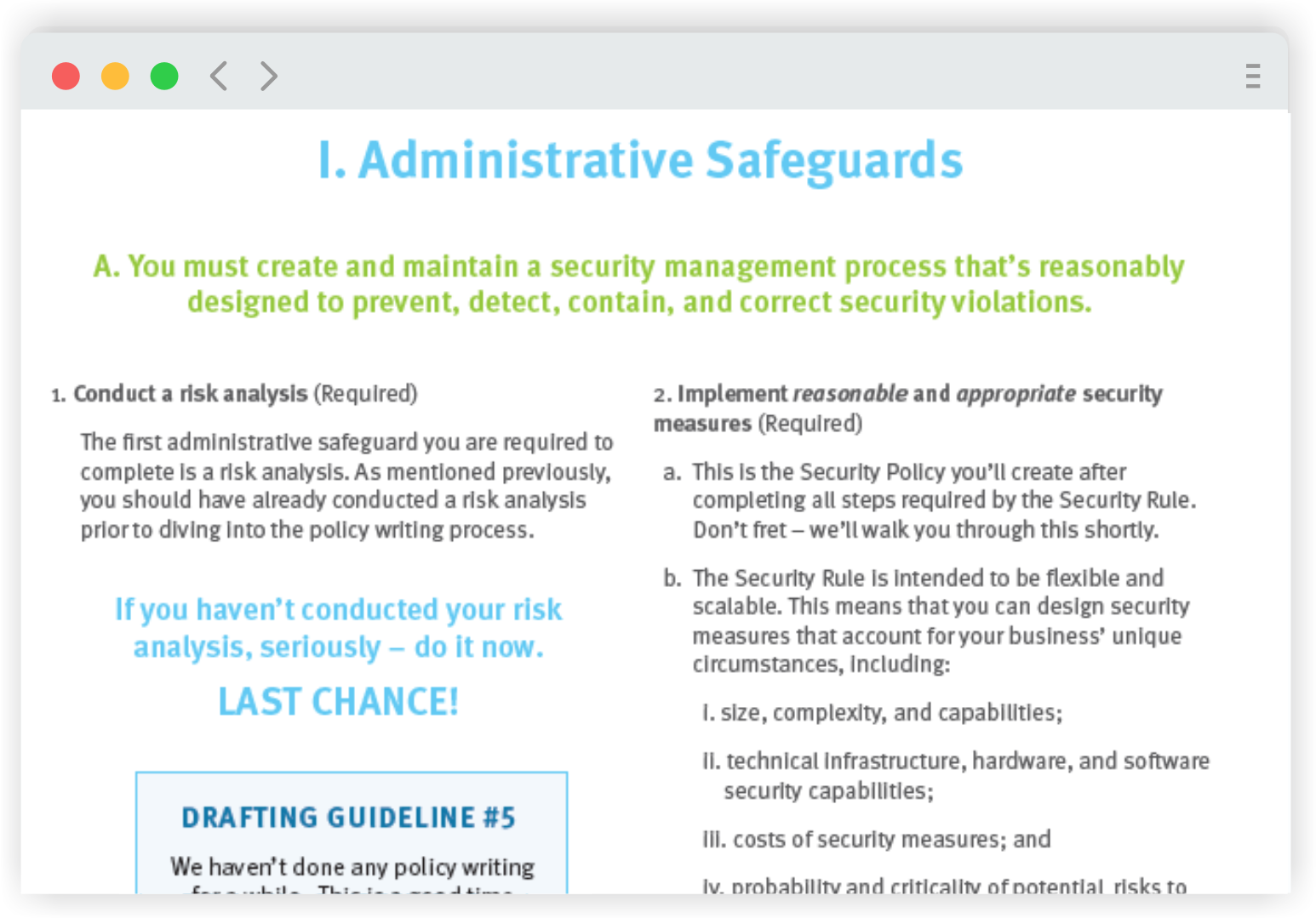

Privacy and Security Policies

Protect your PHI and ePHI with customized policies and procedures. HIPAA10 not only provides downloadable templates but also offers guides for creating, customizing, and implementing your policies.

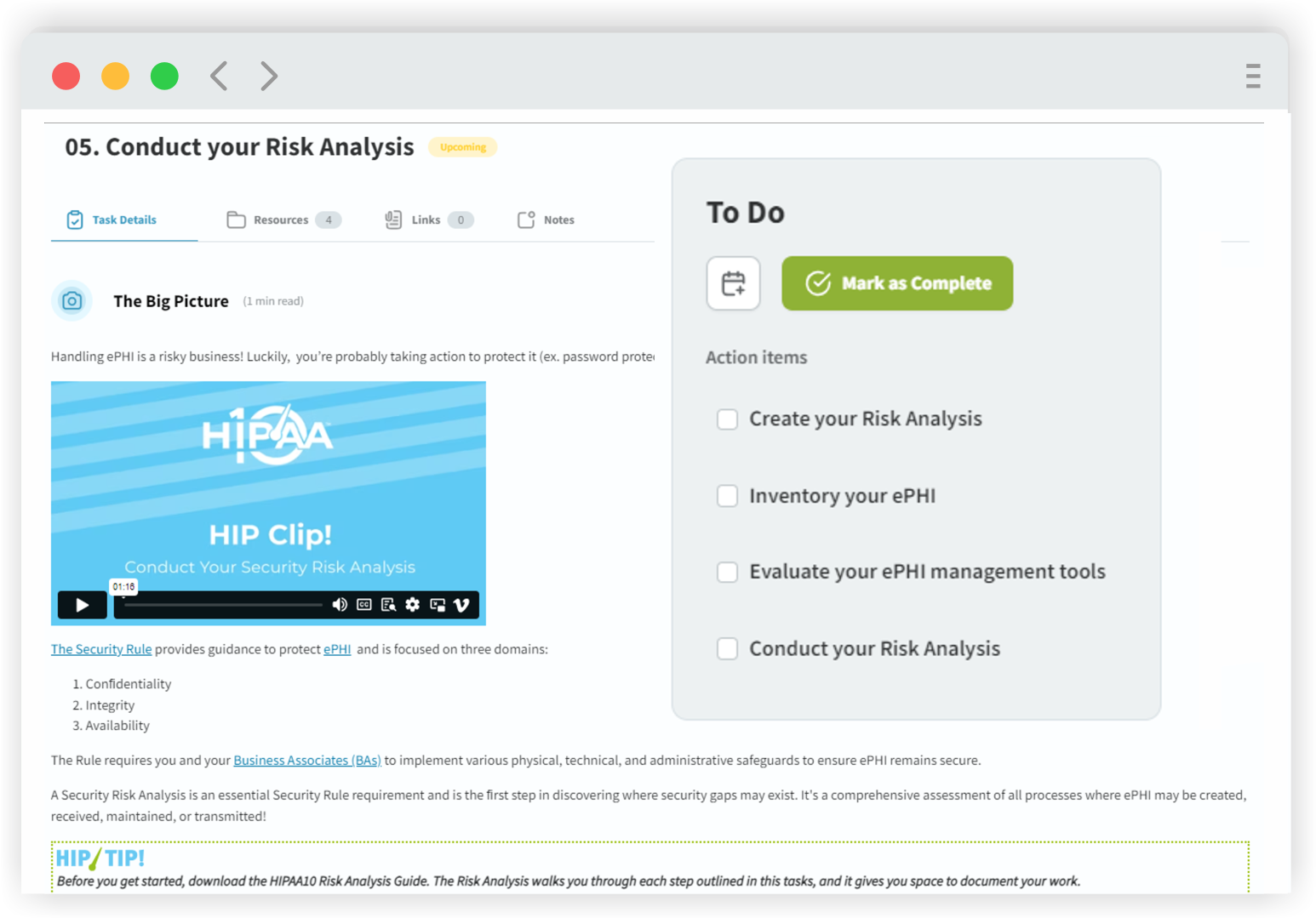

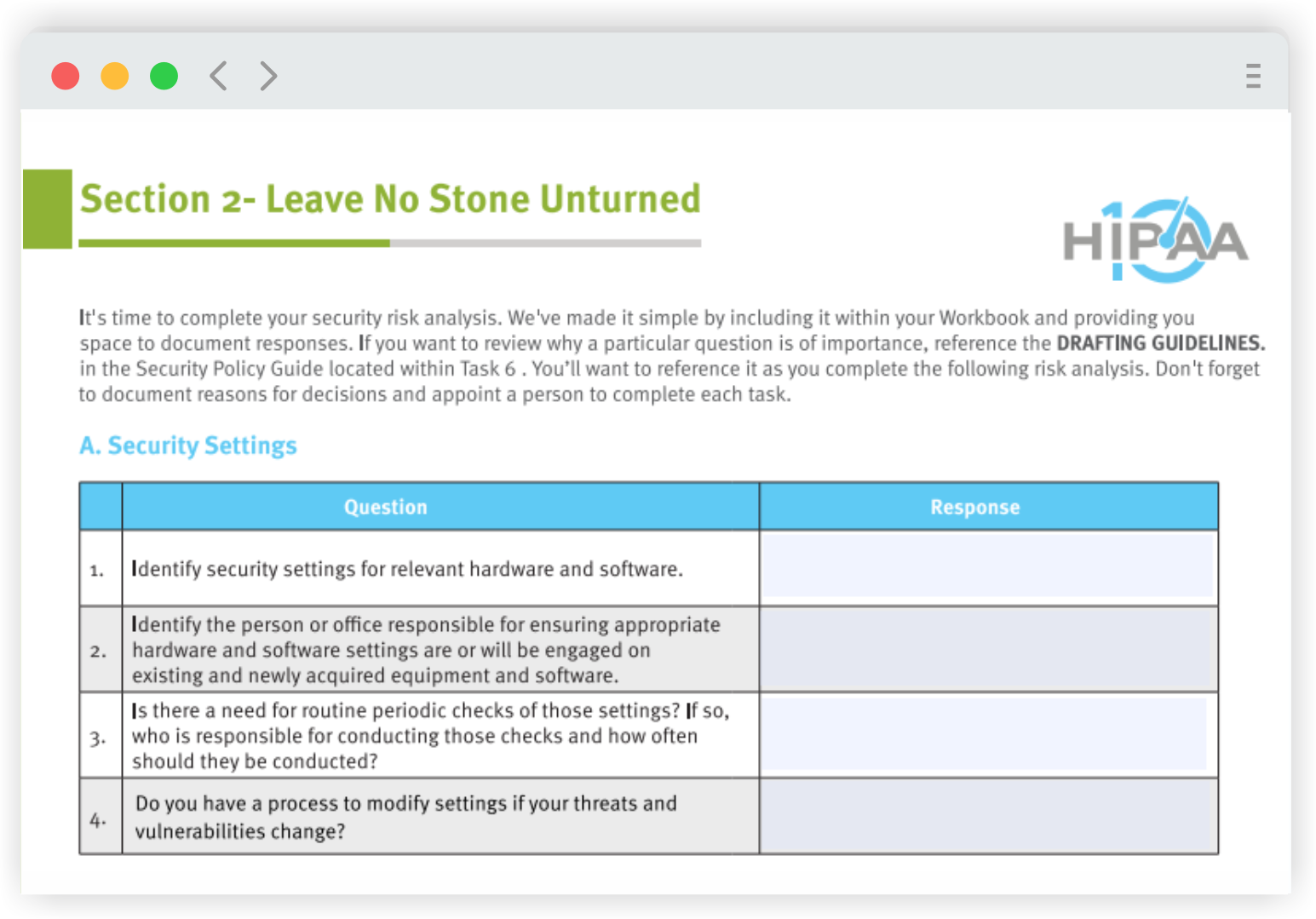

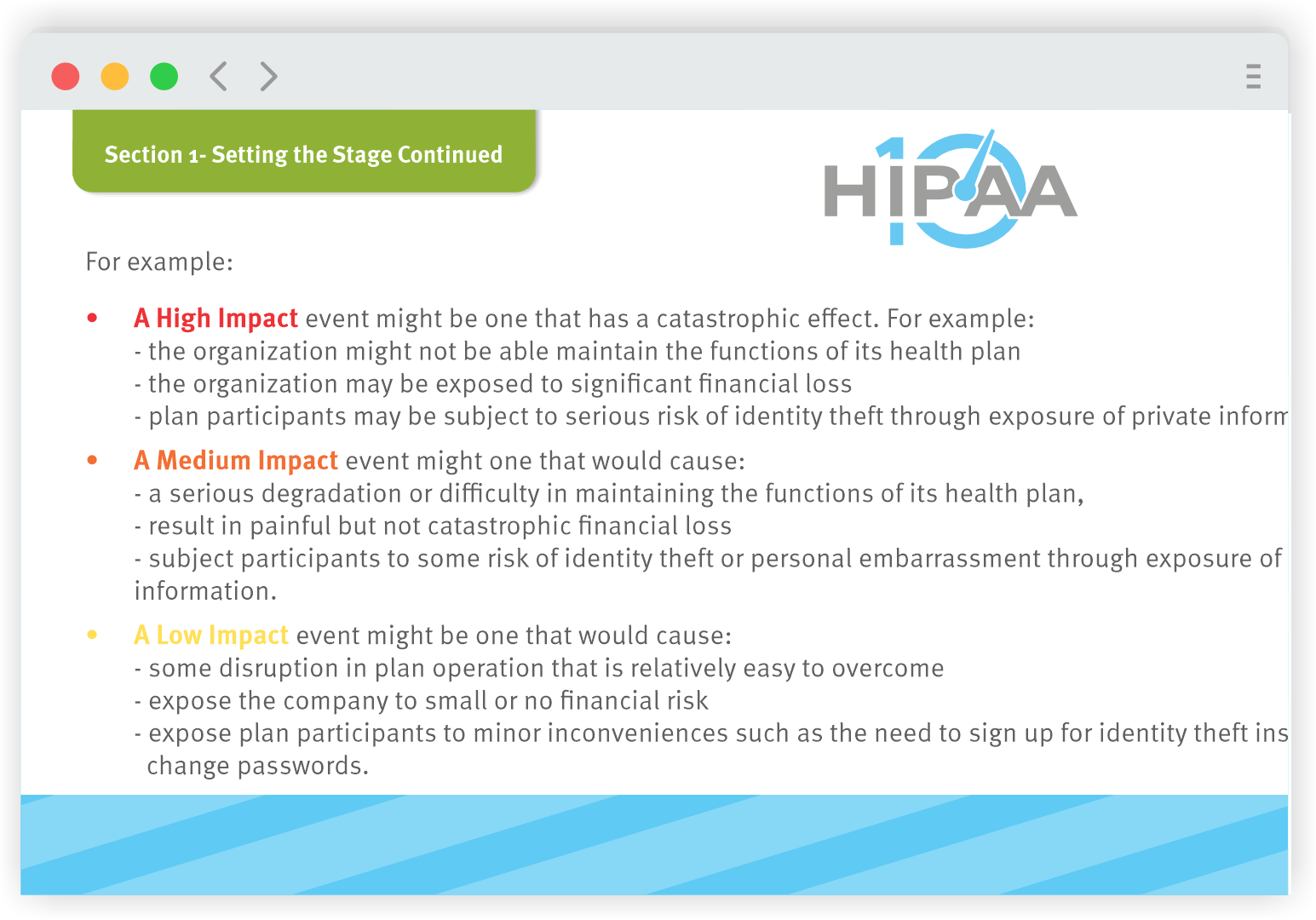

Risk Analysis

Anticipate where your ePHI is vulnerable before a cybersecurity issue arises! A thorough risk analysis is both required by HIPAA and integral to creating your Security Policy. HIPAA10’s risk analysis tools help you prep, plan, and assess your risk.

Staff Training

Policies are only useful if staff know how to follow them. Ensure your staff understand how to follow your HIPAA policies with HIPAA10’s customizable training resources.

And more!

HIPAA10 provides the resources you need to appoint HIPAA officers, manage Business Associates Agreements, prepare for a privacy breach, and maintain compliance as your business changes.

Expanded Preventative Services for Plan Year 2026: Breast Cancer Screening

On 12/30/24, the Health Resources and Services Administration (HRSA) issued a notice including an important revision focused on “Breast Cancer Screening for Women at Average

Mental Health Parity Final Rule (MHPAEA) Under Review by Agencies

Attention HR pros and benefit brokers! Portions of the Mental Health Parity Rule (MHPAEA) are under review by the agencies overseeing it. It’s shaping up

New Administration Takes HIPAA Security Rule Complaints Seriously

What HR Pros Need to Know About the Latest OCR Enforcement Update Here’s the key takeaway from the latest HIPAA Security Rule enforcement update: the

Boost Benefits Compliance (and Your HR Cred!)

We’re well on our way into the second quarter, and now’s the perfect moment to showcase your benefits compliance skills. With deadlines looming and tasks