Reducing risk.

MEWAComply helps MEWA fiduciaries manage

and track their compliance obligations.

How is MEWA Comply making compliance simpler?

By clearly showing the unique responsibilities that a MEWA fiduciary has.

Trustees can easily understand their complex and specific roles.

By delegating compliance tasks to member organizations.

A clear division of responsibility ensures everyone is staying on top of compliance.

By organizing and tracking tasks throughout the year.

Reporting, email reminders, and document storage keep everyone organized and audit ready.

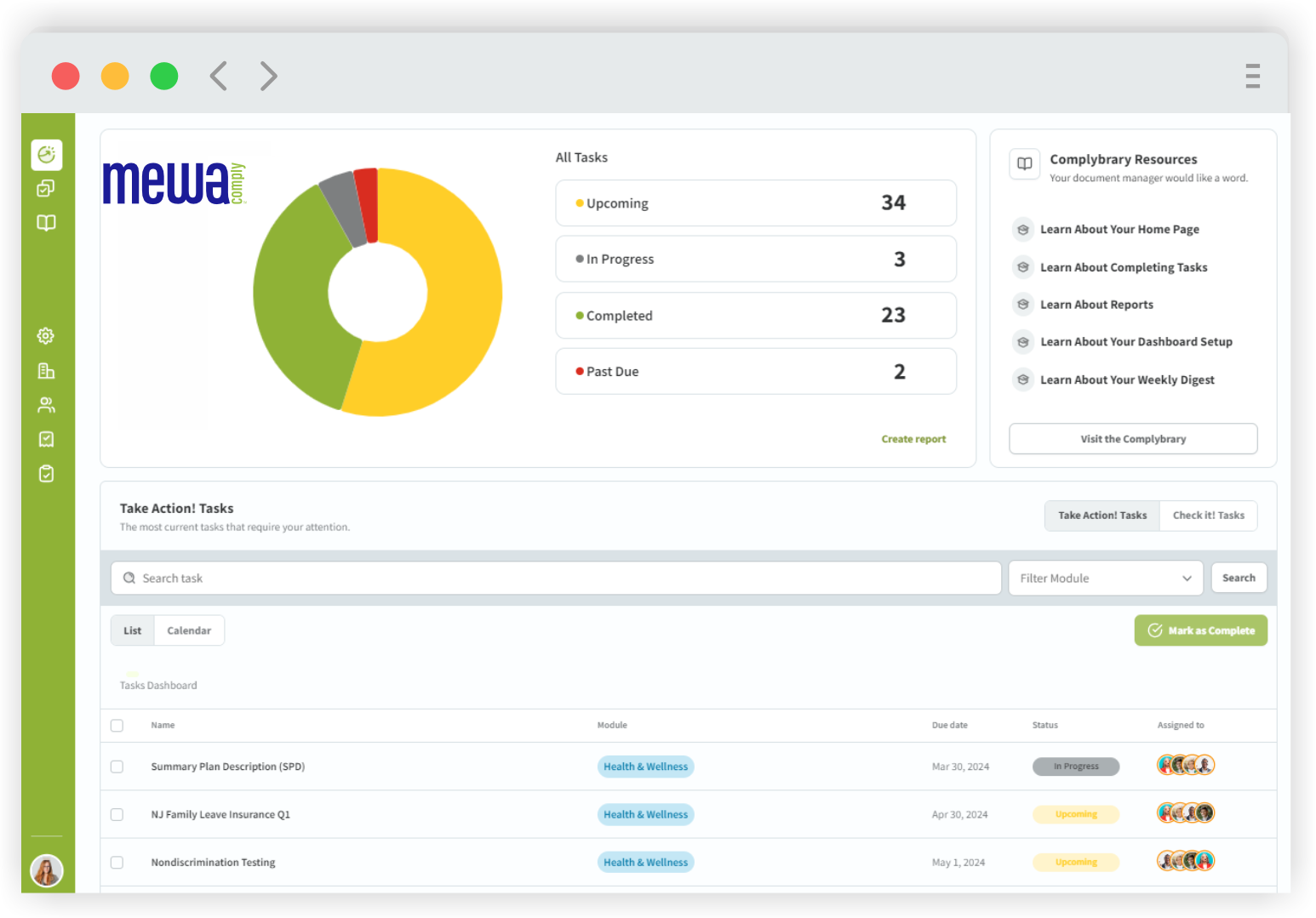

MEWA-specific Dashboard

Assist even the most complex of plan arrangements through our MEWA-specific dashboard.

MEWA compliance CAN be simpler!

What’s Going on With Maryland’s Paid Family Leave Insurance (FAMLI) Program?

Big news from Maryland: The implementation of the state’s Family and Medical Leave Insurance (“FAMLI”) program has just been officially delayed. While we were previously

HHS Workforce Reduction: What It Means for HIPAA and ERISA Compliance

The White House has recently announced that HHS is reorganizing and will reduce its workforce by 20,000 employees. This is in addition to the reported

IRS Gives Green Light on New Forms 1095-B and 1095-C Rules

What HR Professionals and Insurance Brokers Need to Know About Notice 2025-15 The IRS recently released Notice 2025-15, clarifying how employers may comply with the

ERISA Ruling Emphasizes the Need for Detailed Denial Notices

Recent ERISA Ruling In Doe v. Deloitte LLP Grp. Ins. Plan, the Southern District of New York recently ruled for the plaintiff and gave insight