Seriously simple.

Compliance is complicated.

The Dashboard combines the most streamlined tracking platform in the industry with powerhouse legal guidance to make employee benefits compliance simpler. Seriously.

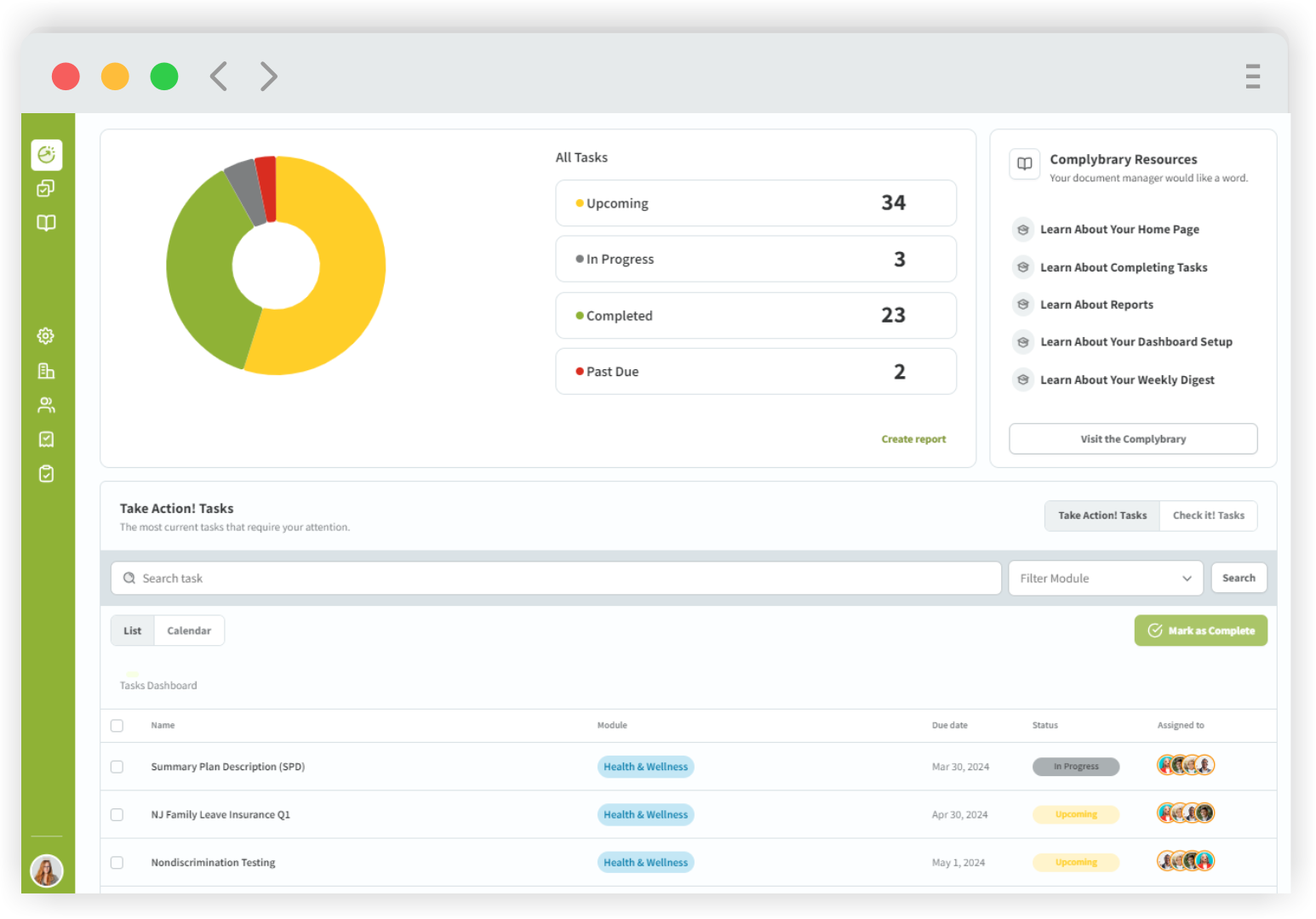

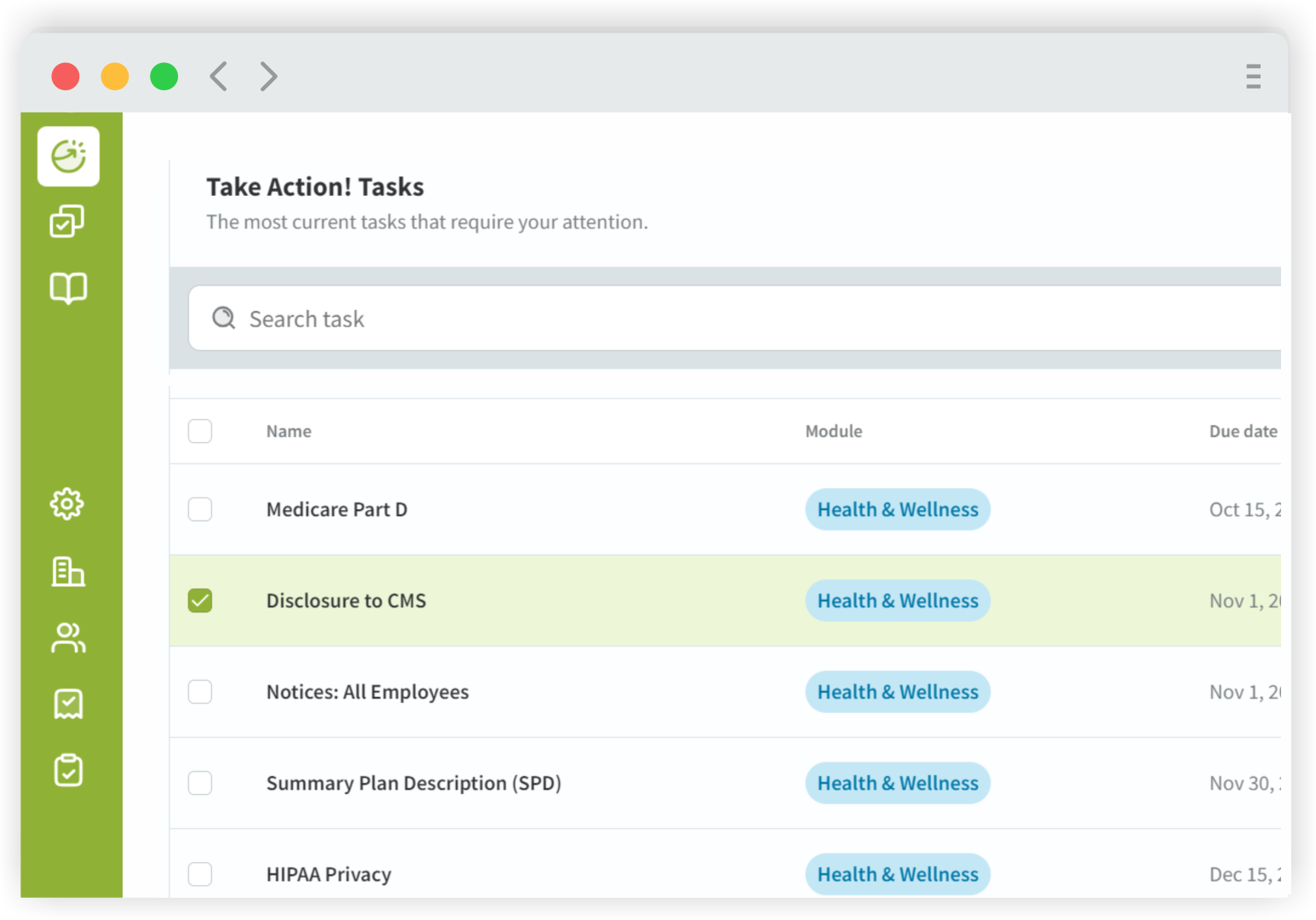

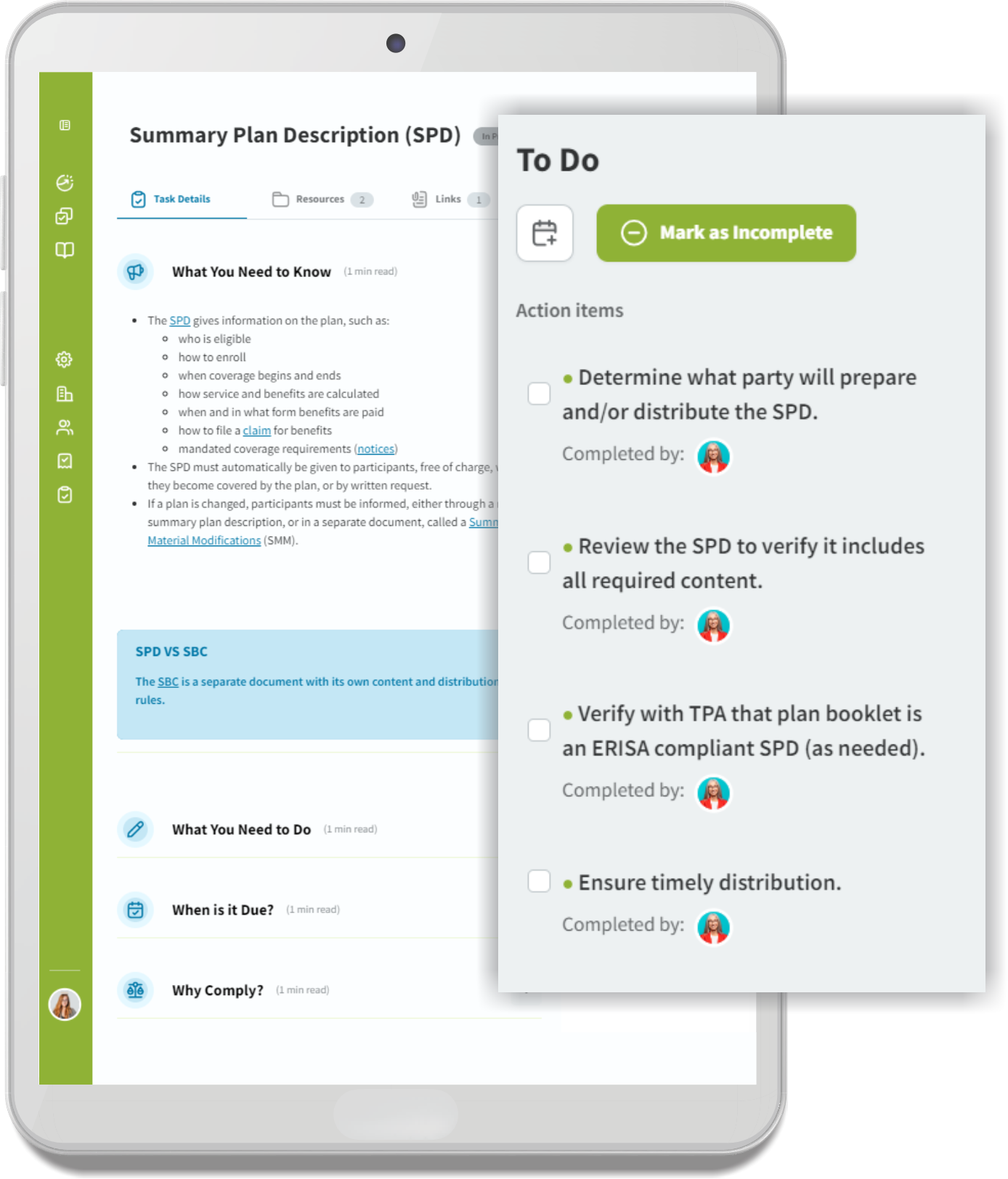

No More Checklists!

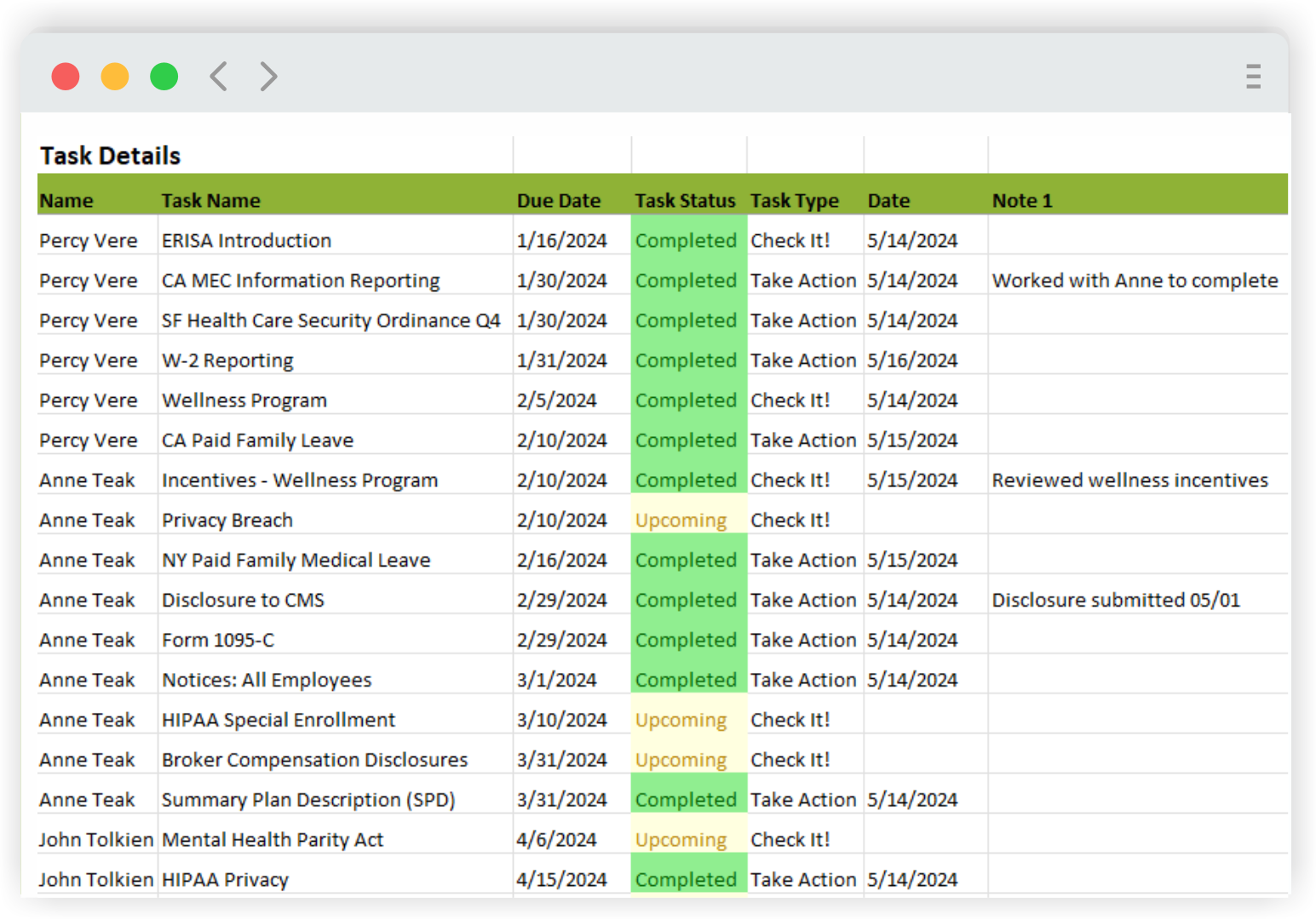

The Dashboard’s compliance calendar and task lists are customized to each employer’s company details and benefits plan.

See at-a-glance where you stand with your yearly compliance obligations and the most urgent tasks that need completed.

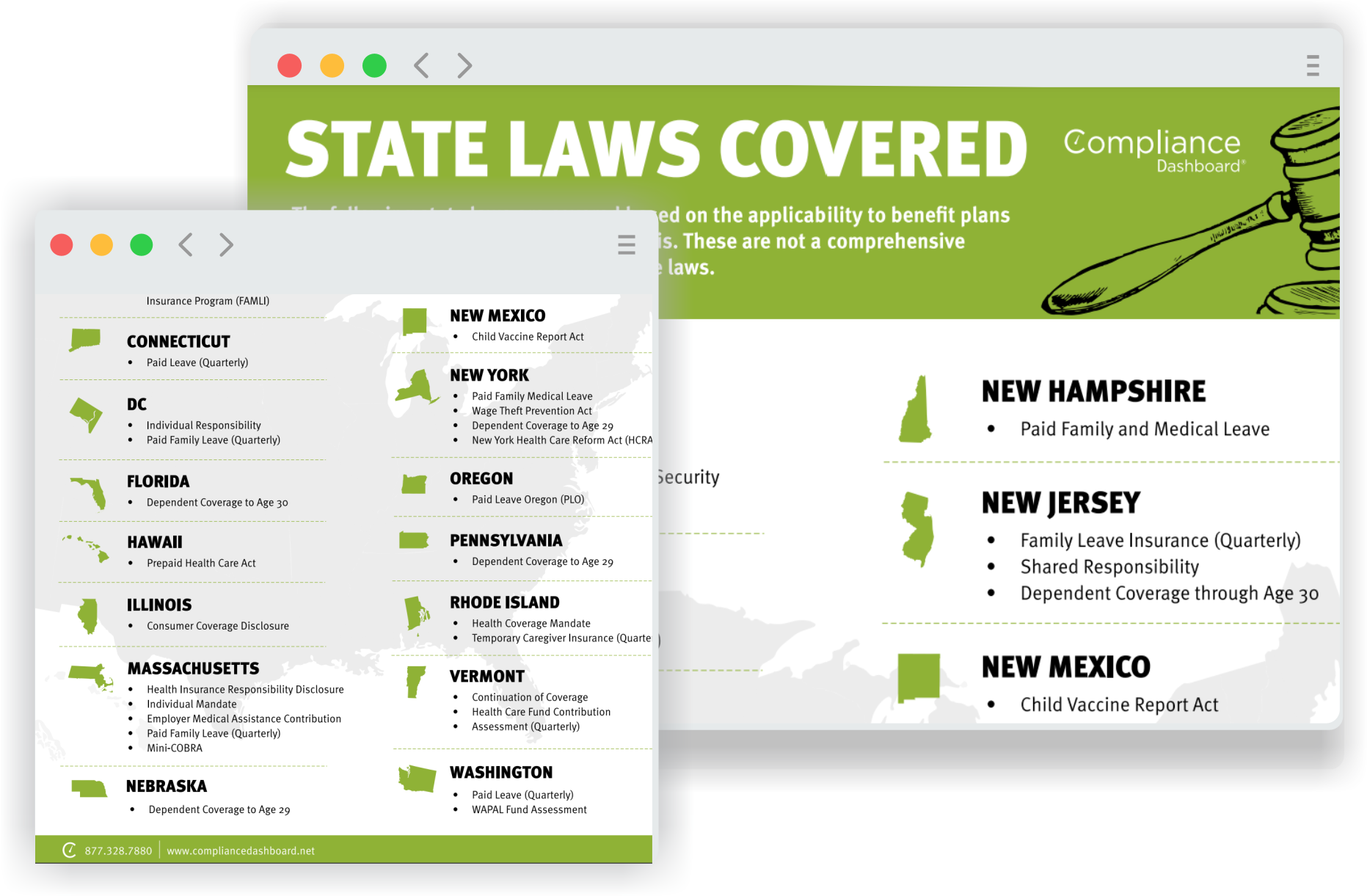

Covers both federal and state benefits laws.

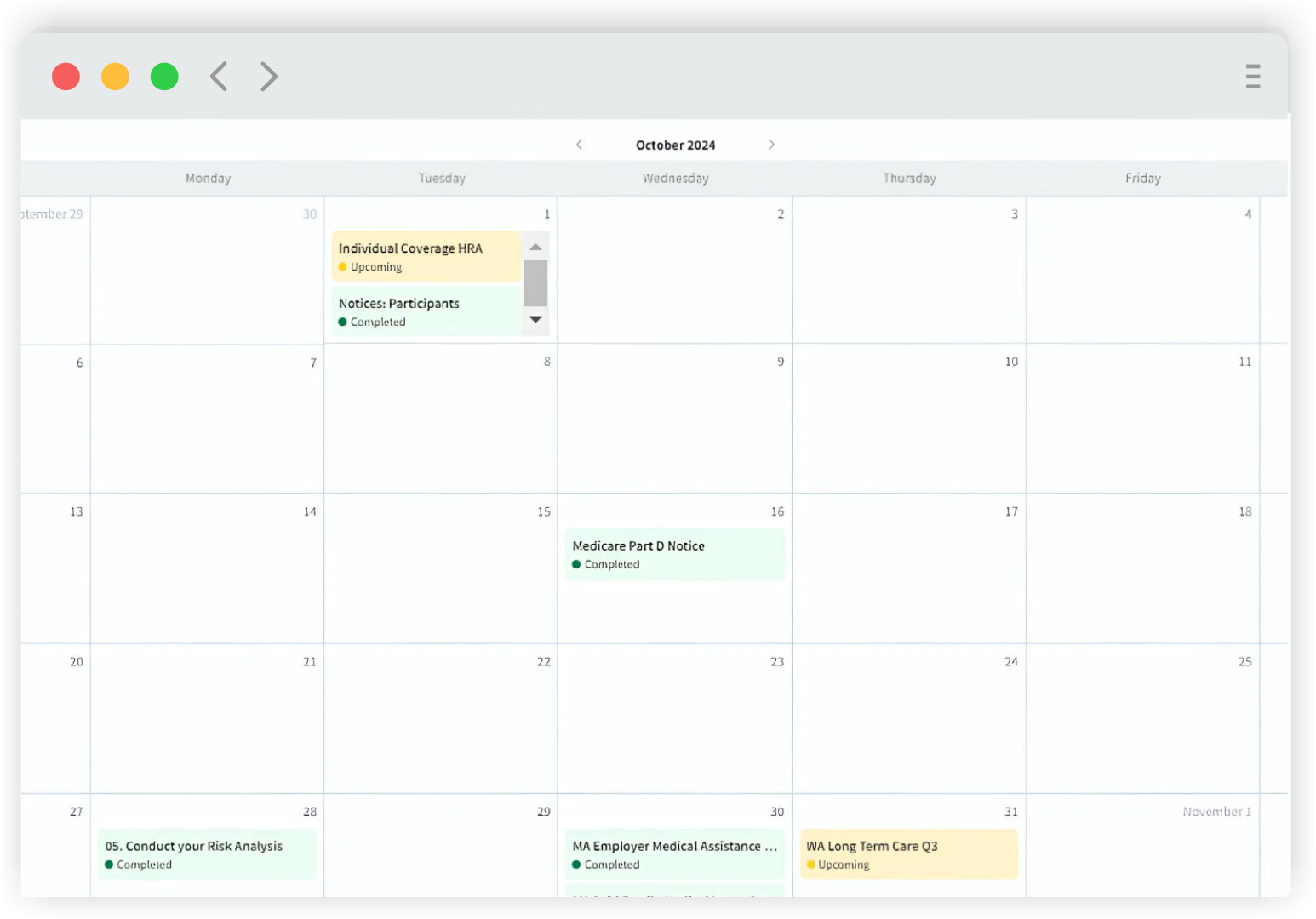

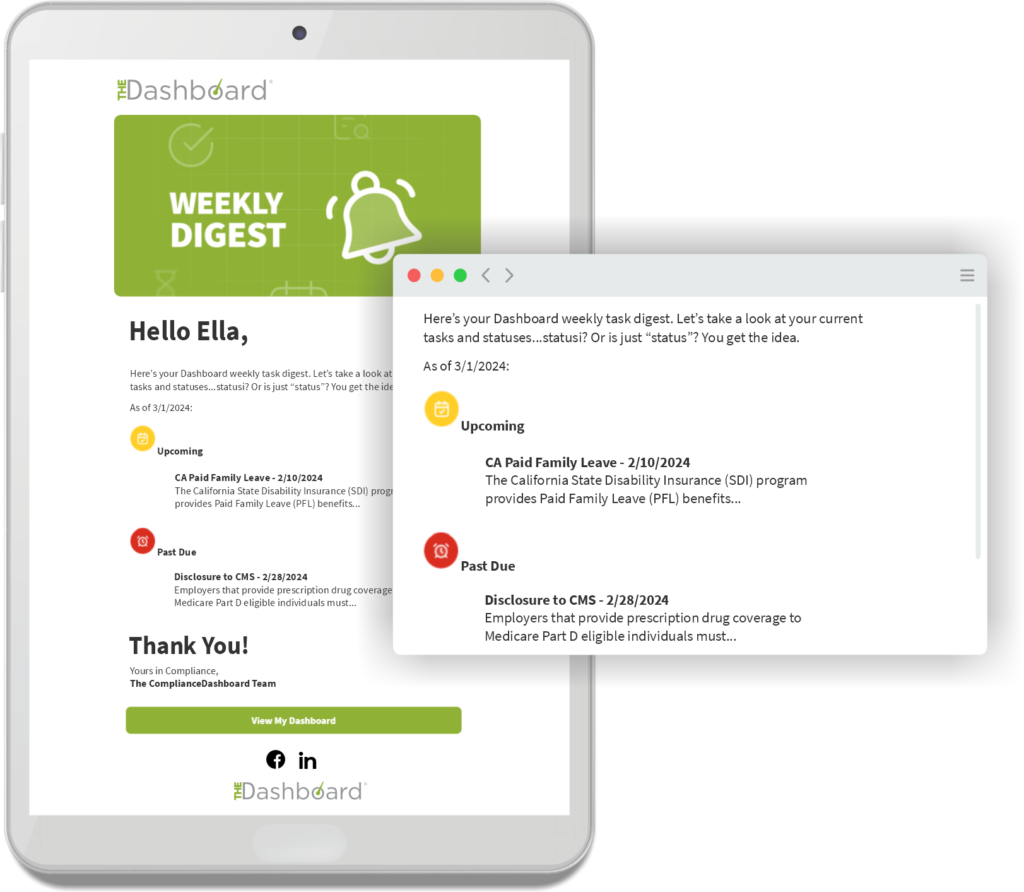

Never Miss a Deadline

With regular email and calendar reminders.

The Weekly Digest email summarizes upcoming and past due compliance tasks. Add calendar reminders for extra peace of mind.

Don't Sweat State Law!

The Dashboard’s quick-and-easy setup automatically determines the compliance tasks that apply based on company and plan details, including both federal and state benefits requirements.

Check out the laws covered on The Dashboard here.

New to Benefits Compliance?

The Dashboard’s step-by-step guidance was written with all levels of compliance experience in mind. Task pages focus on actionable steps to stay in compliance, and provide deep-dive content, charts, and sample documents to tackle your most complicated compliance headaches.

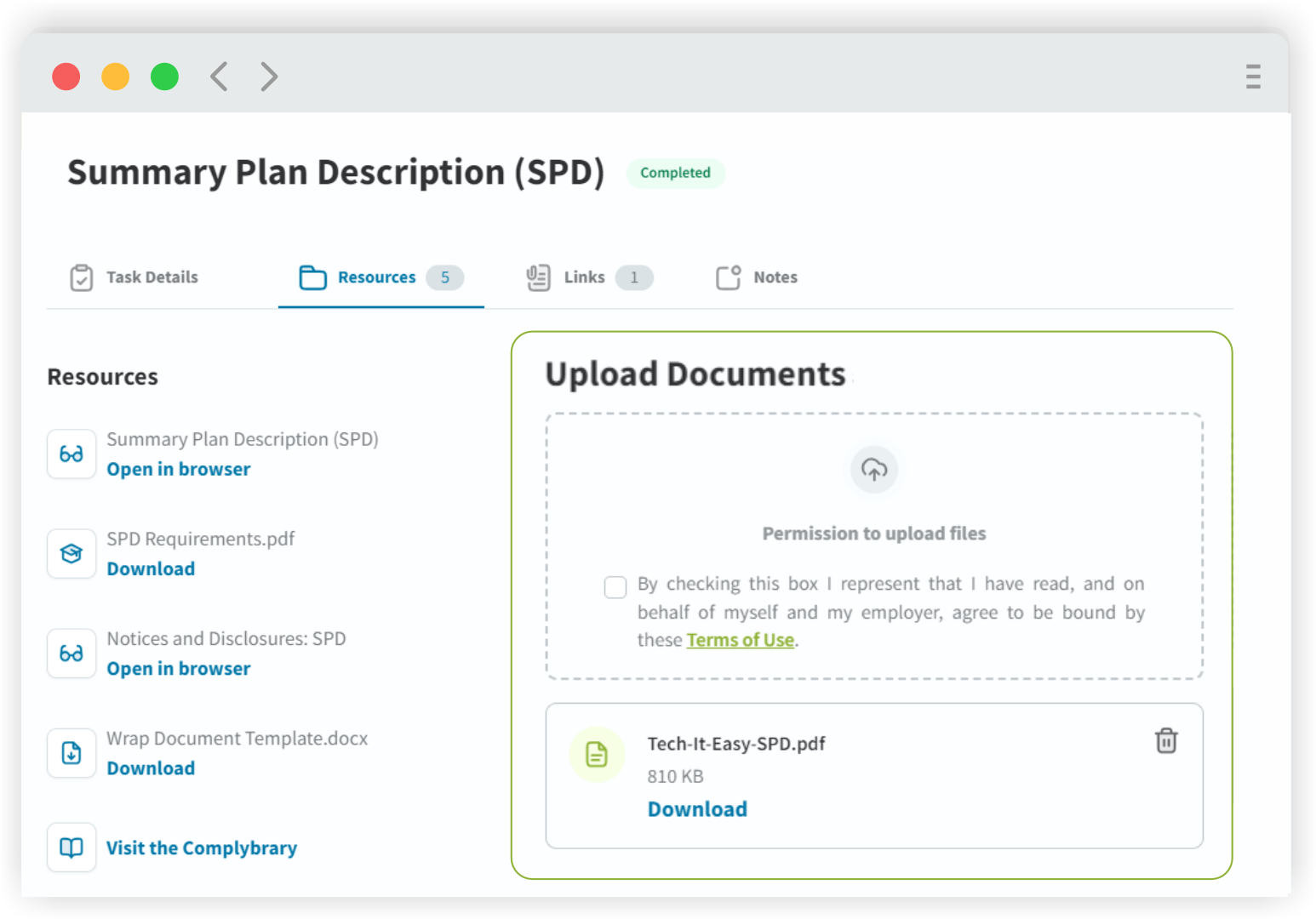

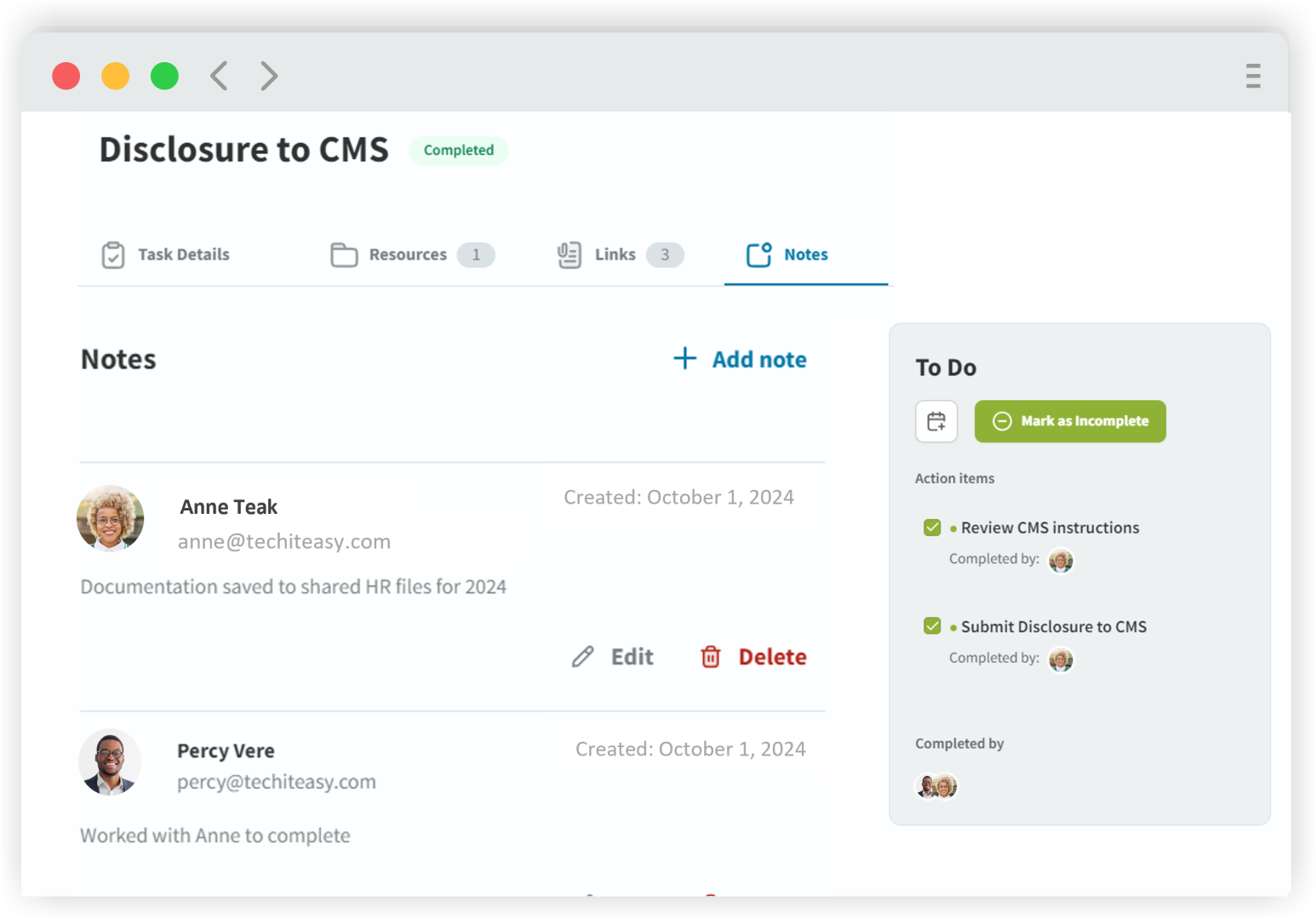

Audit Ready?

Documentation is half the battle. Complete tasks, add notes and comments, and upload documents for easy retrieval in the case of a DOL investigation, internal audit, merger or acquisition, or to make available for performance reviews.

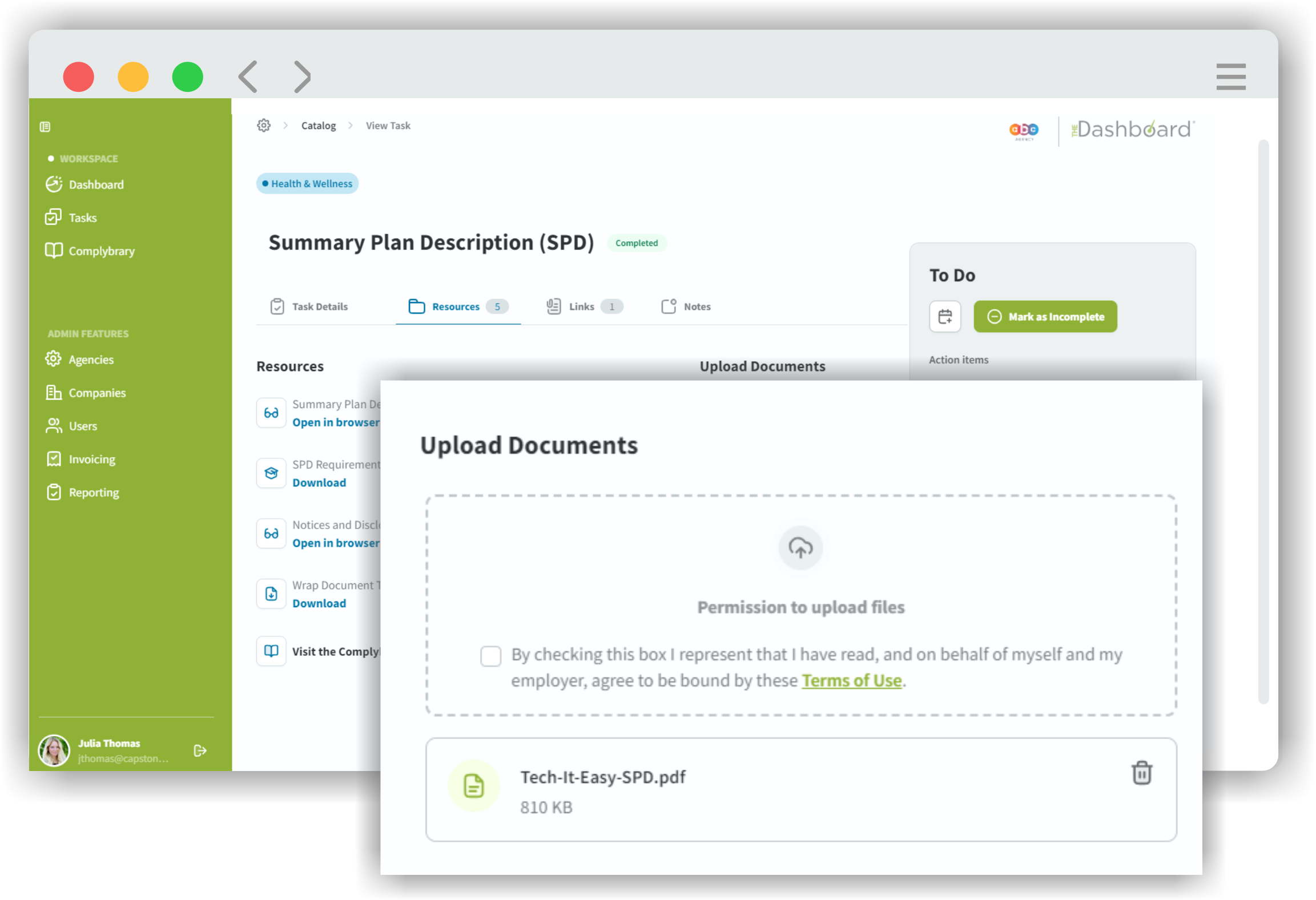

Keep It In the Cloud.

Store plan documents in our cloud-based document manager.

HHS Workforce Reduction: What It Means for HIPAA and ERISA Compliance

The White House has recently announced that HHS is reorganizing and will reduce its workforce by 20,000 employees. This is in addition to the reported

IRS Gives Green Light on New Forms 1095-B and 1095-C Rules

What HR Professionals and Insurance Brokers Need to Know About Notice 2025-15 The IRS recently released Notice 2025-15, clarifying how employers may comply with the

ERISA Ruling Emphasizes the Need for Detailed Denial Notices

Recent ERISA Ruling In Doe v. Deloitte LLP Grp. Ins. Plan, the Southern District of New York recently ruled for the plaintiff and gave insight

RxDC Reporting: What HR Pros and Brokers Need to Know

Understanding the RxDC Reporting Process The RxDC (Prescription Drug Data Collection) reporting process is established by federal regulation to promote greater transparency in healthcare spending.